Its never been easier to invest in your future with access to many different online investment trading platforms. Nathan-Paul wanted to do a deep dive on one of the most popular investment trading platforms WealthSimple and give you a comprehensive look at all the pro and cons so you can make an informed decision.

Online asset management provider Wealthsimple Inc. is based in Canada. Wealthsimple was founded in September 2014 by Rudy Adler, Brett Huneycutt, Som Seif, and Michael Katchen and currently has Over C$38.7 billion in assets as of March 31, 2024.

PROS

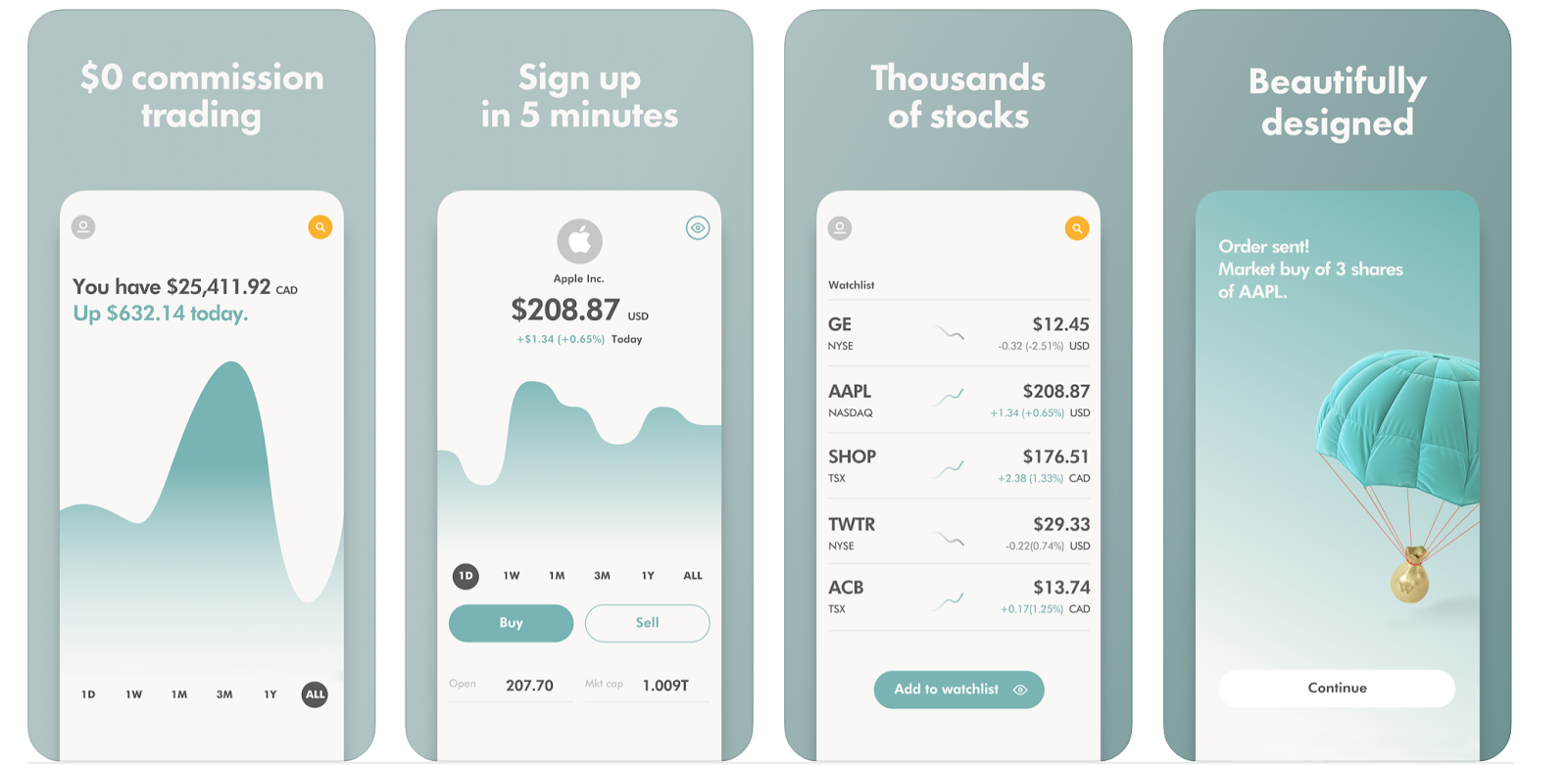

- User friendly interface

- No minimum deposit required

- Dividend reinvesting

- Valuable benefits

- Allows automated deposits

- Many different accounts including crypto

- Low management fee

CONS

- Quotes are not in real time

- Only available to Canadian citizens

- Funding restricted to Canadian dollars

- Currency conversion fees

- 24/7 support not offered

- Trading fees on crypto 1.5-2%

- No RESP offering

WEALTHSIMPLE RATINGS

| INVESTMENT OPTIONS | |

| CUSTOMER SUPPORT | |

| REASEARCH TOOLS | |

| COMMISIONS / FEES | |

| EDUCATION | |

| CRYPTO OPTIONS | |

| MOBILE APP | |

| OVERALL |

WEALTHSIMPLE PRODUCTS

WealthSimple Cash – Mobile app that lets you send, request, and receive money instantly with 1% cash back, crypto, or stock rewards on all purchases. WealthSimple cash card is accepted anywhere Mastercard is used and any deposit over $500 earns 3% interest.

WealthSimple Crypto – Commission-free self-directed cryptocurrency trading platform. It is the first cryptocurrency marketplace in Canada with regulation that enables trading in digital currencies like Ethereum and Bitcoin. Through the site, users can purchase, sell, or store cryptocurrencies it offers no commission, no minimum account balance requirements, and no fees for deposits or withdrawals.-no commissions

WealthSimple Trade -Canada’s sole commission-free trading platform with no additional costs while buying and selling thousands of stocks. WealthSimple Trade provides access to fractional shares, free stock promotions, no account minimum, and other cutting-edge features.

WealthSimple Invest – An individualised portfolio of inexpensive exchange-traded funds is used by Wealthsimple Invest, an automated investing service, to manage users’ investments. It provides actual human guidance and creates affordable portfolios based on consumers’ objectives.

WealthSimple Tax -Web-based tax filing software for Canadian residents for simple tax returns. This donation-based program works well for people with very straightforward tax situations.

CONCULSION

To sum up, Wealthsimple is a well-known platform for managing investments that provides users with an easy-to-use interface. It is an appropriate option for novices and those looking for a straightforward and automatic investment solution due to its easily accessible and varied investment choices.

Although Wealthsimple may have certain drawbacks, like a lack of personalization options and research offers, its easy-to-use platforms and inexpensive index funds make it a desirable choice for many investors.